Have you ever wondered about how you can build wealth beyond homeownership? The lifestyle and career benefits of renting are clear—mobility, career flexibility, fewer headaches over home fixes. But what about the financial benefits?

As a renter, you certainly save on upfront costs (no down payment) and unexpected costs (no leaky roof repair bills), but a rent payment isn’t as clear an investment in your financial future as a mortgage.

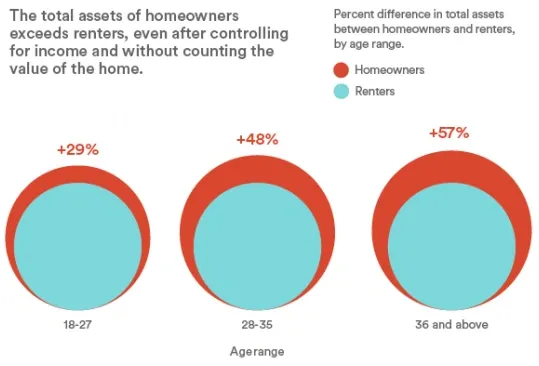

In fact, when it’s time to build wealth, it seems homeowners are actually at an advantage. The median net worth of homeowners is significantly higher than that of renters, according to a report from Harvard’s Joint Center for Housing Studies. Earnest data found homeowners have significantly more assets compared to renters controlling for income and excluding the value of the home.

Source: Earnest

There’s no single, clear reason for the gap. The act of owning a home doesn’t guarantee a person will have more non-equity savings, but a down payment and mortgage could also serve as behavioral incentives for saving. It might also be that people who are more focused on saving and building wealth are more inclined to own a home in the first place.

“The types of people who buy are more likely to save,” Linnea Gandhi, managing director of behavioral science at the TGG Group, says. “Once you’ve decided to buy, you start saving more in preparation.”

The gap, regardless of reason, points to the need to “promote saving outside of employment and by means other than homeownership” for both renters and owners, noted the Harvard study.

This raises a question for renters: If a large portion of your paycheck is going to your landlord every month—and not your net worth—what other actions can you take to ensure you’re forming healthy financial habits? And for homeowners: What are some ways you can continue to save after you’ve made such a large investment? For both parties, a basic understanding of behavioral finance can light the way.

Be Wary of Anchoring

One of the first steps to build wealth is learning how to save, explains Carrie Friedberg, a San Francisco–based certified money coach and financial behavioral specialist.

For most people, saving requires a budget—and in the aggregate, it’s a useful tool. Renters may have heard of the 30% rule: budget 30% of your income toward your housing. Mortgage lenders use a similar ratio for homeowners. But relying on these figures can lead to “anchoring,” where people focus too heavily on the first piece of information offered to them when making decisions.

Say, for example, a renter’s monthly take-home income is $5,000. The 30% rule says $1,500 goes to rent. But according to a study conducted by Brigham Young University in 2012, once a shopper sets a target price, they begin comparing what they can afford with higher-quality and higher-priced items.

Homeowners have the benefit of a fixed monthly mortgage (depending on interest rates, of course), but if you’re a long-term renter who changes locations every few years, anchoring could lead you to overpay for apartments based on your salary increases alone. In other words, you might be budgeting $900 on base rent when the $750 unit is just fine for your needs.

“There is no magic, one-size-fits-all formula,” Friedberg says. “You have to consider your whole financial picture, including debt, spending habits, and other responsibilities.”

Set up Automatic Savings

Even with a set budget, though, learning to save doesn’t necessarily get easier.

For renters, it’s smart to set up automatic deposits every month into a savings account. This can act like a stand-in mortgage by eliminating decision fatigue and “forcing” you to practice self-control without thinking about it. Homeowners, take note, too—having additional savings outside of home equity, such as a safety net fund, is generally a very good idea.

“There is an amazing experience of emotional and financial security that comes from having several buckets of savings. Real estate is just a piece of that,” Friedberg says.

Gandhi offers a study called “Save More Tomorrow” from the University of Chicago as an example of how automatic savings builds wealth. The researchers found that by enrolling people in an opt-out program in which they committed in advance to saving a portion of their future salary, savings rates increased from 3.5 to 13.6% over 40 months.

“If you know you have a steady income coming in, you should totally feel comfortable taking a percentage and allocating it [toward savings],” Gandhi says.

Use Investment Tools

Of course, setting up automatic transfers doesn’t mean you won’t trip up.

“Humans are naturally focused on the present over the future,” Stephen Wendel, head of behavioral science at investment app Morningstar, says. “It’s a really good thing in our daily lives. It’s just not a good thing when we try to save.”

Wendel recommends looking for tools to help form healthy financial habits, which often include features specifically designed to combat behavioral biases. The general rule in behavior science is that simple awareness isn’t enough, he says.

He gives the example of “availability bias”: “People tend to go after what’s talked about in the media or by colleagues—what seems ‘hot.’ They are more likely to remember, and then invest in, frequently mentioned investments.”

That’s where a platform like Morningstar can come in handy: The tool is designed to help people develop long-term investment strategies and avoid chasing short-term fads.

If you have any other questions, please contact us here.

By Authors at Earnest, July 8th 2020